epf withdrawal i sinar

The withdrawal amount will vary depending on. For now they are only accepting applications for members under Category 1 which do not require.

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

If you need extra cash the i-Sinar program by the Employees Provident Fund EPF is now open for application.

. The wildcard here is the RM90 billion withdrawals from the i-Sinar Account 1 which forms the bulk of the RM130 billion that EPF had released and is releasing to members and the economy from various EPF-related initiatives from April 1 last year specifically how significantly it affects the growth of members total savings and EPFs cumulative assets which. The EPF i-Sinar initiative enables EPF members to make a partial withdrawal from their savings in EPF Account 1. This is highlighted in EPFs statistics that 66 million members have less than RM10000 in their savings.

2 days agoKUALA LUMPUR Aug 8. KUALA LUMPUR Feb 11. The level of savings of Employees Provident Fund EPF members is low and very worrying especially after the implementation of four withdrawal facilities which saw a RM145 billion withdrawn by members said Deputy Finance Minister I Datuk Mohd Shahar AbdullahThe four withdrawal programmes that took place due to the Covid-19.

During the past two years Malaysians have been allowed to make several rounds of withdrawals from their EPF savings through i-Lestari i-Sinar and i-Citra schemes which resulted in a withdrawal of RM 101 billion by 74 million members. I-Sinar i-Citra as well as the special one-off withdrawal of RM10000 had seen. Yesterday the EPF said it expects the i-Sinar facility to benefit two million eligible members with an estimated advance amount of RM14 billion to be made available.

More than half of EPF members aged under 55 now have savings of less than RM10000 says deputy minister. - A A. 2 days agoThe level of savings of EPF members is low and very worrying especially after the implementation of four withdrawal facilities related to COVID-19 namely the i-Lestari i-Sinar i-Citra and special withdrawal.

In fact 80 per cent of the members have yet to achieve basic savings to retire comfortably Ahmed Razman told Sinar Daily. The deputy minister said that this worrying level of savings was exacerbated by the implementation of four Covid-19-related withdrawal facilities namely i-Lestari i-Sinar i-Citra and the RM10000 special withdrawalThis is on top of a reduced statutory contribution rate for members for a period of 27 months from April 2020 to June 2022. This initiative was launched by the EPF for the purpose of easing the financial burden of members whove been affected by the Covid-19 pandemic helping them sustain their livelihood.

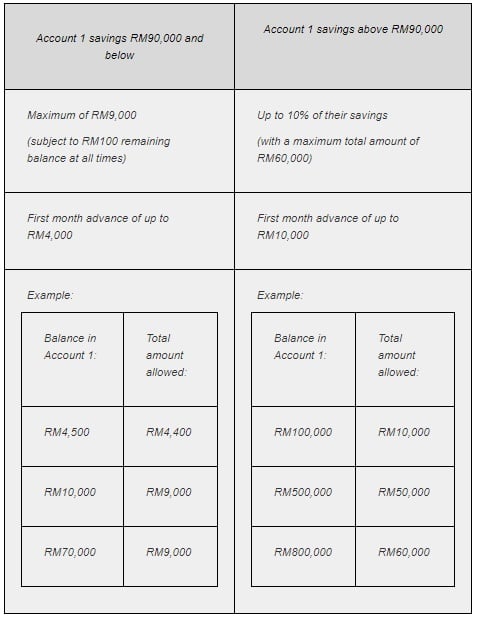

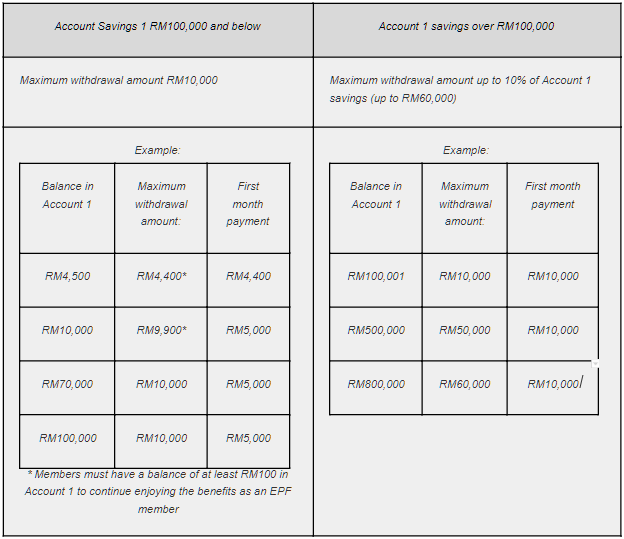

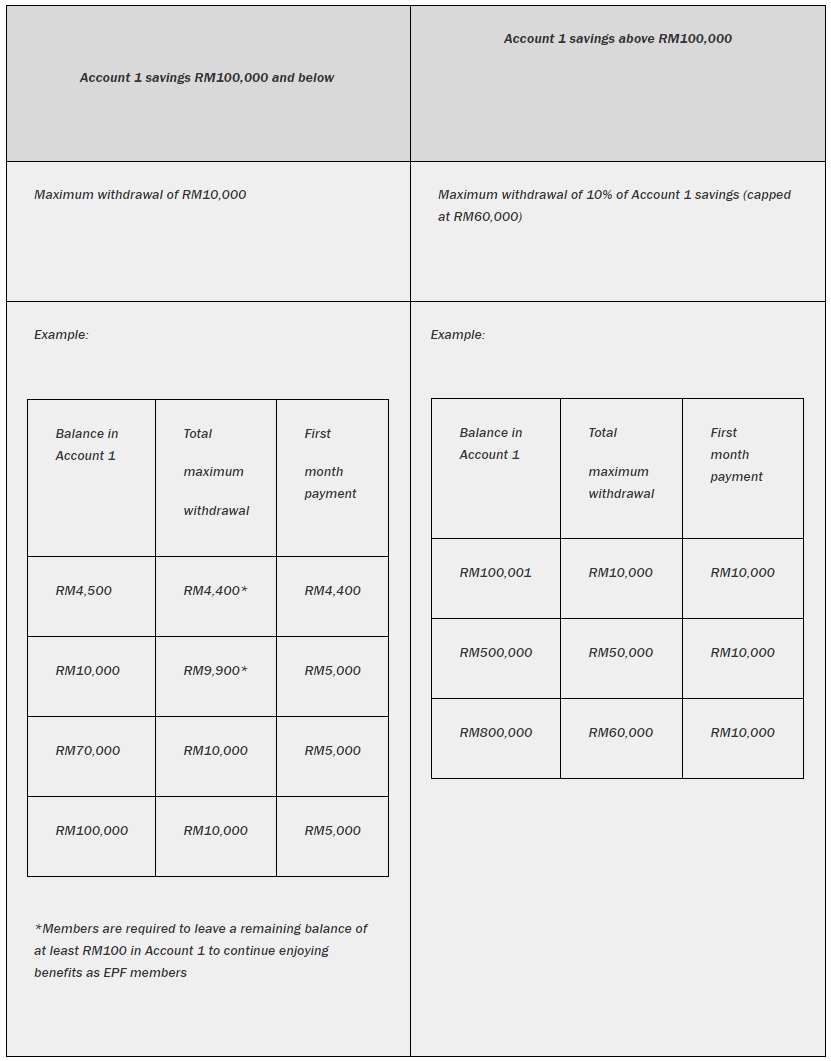

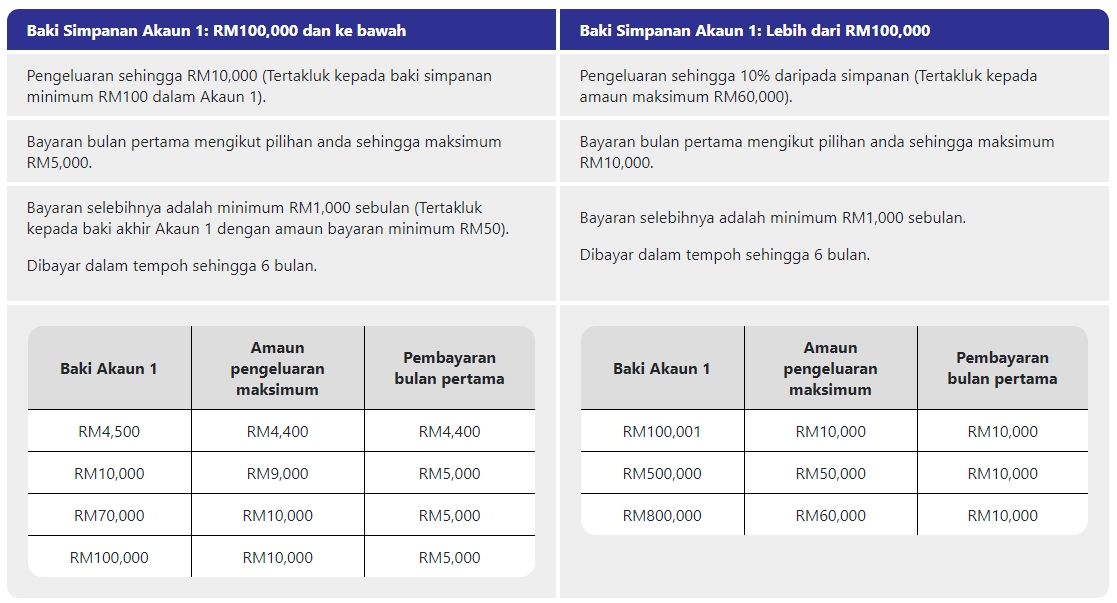

This is a withdrawal facility where members can withdraw up to RM60000 from Account 1. Eligible members should only utilise it for urgent basic needs when there is no other choice. And the reduction of the employee share statutory contribution rate for a period of 27 months April 2020 until June 2022 he said.

The Employees Provident Fund EPF will be removing all conditions for the i-Sinar facility on the advice of Prime Minister Tan Sri Muhyiddin Yassin after receiving feedback from the public. Announcing this in a statement today Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz. Chief executive officer Tunku Alizakri Raja Muhammad Alias said the EPF has widened the scope of i-Sinar to cover active members who have lost their jobs or given no-pay leave or have no.

To date around RM141 billion has been withdrawn from the EPF constituting around 14 per cent of EPFs total assets. The current situation of low savings highlights the limitations in distribution of net wealth. Although the EPF i-Sinar withdrawal is authorized by the government one must not take it for granted.

Tengku Datuk Seri Zafrul Abdul Aziz. 2 days agoThe level of savings of EPF members is low and very worrying especially after the implementation of four withdrawal facilities related to COVID.

I Sinar Category 2 How To Apply And Eligibility Comparehero

Epf I Sinar Akaun 1 Advance Facility What You Need To Know

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Nestia

Epf Announces Terms For I Sinar Withdrawal Japict

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

I Sinar The Pros And Cons Of Withdrawing Money From Your Epf Account Rojakdaily

I Sinar 8 Other Things You Can Use Your Epf For

Bernama Epf Offers Further Details On I Sinar In Response To Media Query

Updated I Sinar Program Details Epf Members Can Start To Apply I Sinar Starting From 21 Dec 2020 News Puchong Co

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

I Sinar And I Citra Not Heavily Impacting Epf Investment At The Moment The Star

I Sinar 8 Other Things You Can Use Your Epf For

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar Applications Are Now Open For Category 1 Here S How To Apply

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

I Sinar Category 2 How To Apply And Eligibility Comparehero

I Sinar A Rm56bil Question Mark The Star

Epf Account 1 Withdrawal I Sinar The Pros And Cons

0 Response to "epf withdrawal i sinar"

Post a Comment